InvestCloud partners with City of Boston for Family Savings Program

Los Angeles and Boston – February 23, 2017 – InvestCloud Inc., a global fintech firm and digital platform, has partnered on a new program with the City of Boston and Boston Mayor Martin J. Walsh to allow families to create long-term savings plans for their children’s education.

Boston Saves, the City’s Children’s Savings Account (CSA) program, allows families to create long-term, goal-based savings plans for college, post-secondary and training education for their children. The program is being run using the InvestCloud digital platform, which allows participating families to easily and quickly access and review their savings plans online using a client portal. This client portal facilitates client communiation and client reporting while increasing financial mobility and giving advisors access to an advisor portal.

“One of the best ways to close the opportunity gap facing some of our young children is to help them save for their educational future,” said Mayor Walsh. “Children’s Savings Accounts are a tool that every family should have access to, and with InvestCloud’s financial technology support, we’re making that a reality. Even a small amount over time can make a big difference, and I am excited for our students and families who will have this new resource to begin saving now for the future.”

Through the digital platform, families will be able to track their progress, earn rewards and benefit from financial savings tips. Linking their savings and checking accounts directly to the digital platform will make it easy to transfer funds and gain a more holistic view of their investments. The digital platform will also allow access to a client portal for enhanced client communication, client reporting, and financial mobility.

John Wise, co-founder and CEO of InvestCloud, said, “Our program with the City of Boston demonstrates the flexibility of the InvestCloud digital platform. It supports the full spectrum of wealth management, from the complex needs of family offices and high-net-worth investors, right through to the needs of normal families. While they might not consider themselves ‘wealthy,’ they can still benefit from our digital platform to help them achieve their lifetime goals and family plans.

“With a greater number of people thinking about how to organize and build their savings, the notion of wealth management is changing fast. But to effectively engage with these new demographics, a simple and intuitive solution is required that can handle massive scale efficiently. The InvestCloud approach ensures all types of wealth and savings can be supported through the digital platform.”

The InvestCloud digital platform utilizes Programs Writing Programs (PWP), a proprietary technology that generates code instead of programmers writing code. This automation allows one business analyst or designer to do the work of 50 developers and ensures updates and upgrades are dramatically simplified – negating the long lead times associated with hard-coded software solutions. It is because of this technological approach that InvestCloud’s solutions could be easily and rapidly adapted to the unique use case of Boston Saves.

The platform is also capable of processing millions of pieces of data and content – from market news to portfolio data – through its digital warehouse. This provides a complete picture of an individual’s wealth, ensures both clients and advisors are able to get a complete picture of wealth, and allows for more effective, more profitable management.

About InvestCloud Inc.

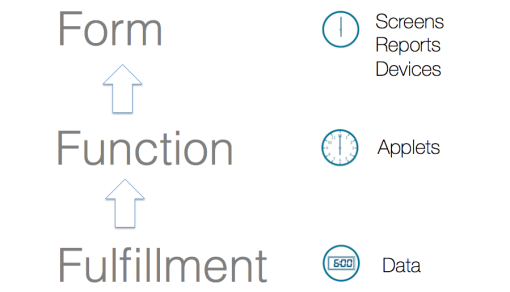

Headquartered in Los Angeles, InvestCloud empowers investors and managers with a single version of the integrated truth through its unique digital platform. Today the InvestCloud platform supports over $1.7 trillion of assets across 670 institutional customers. InvestCloud creates custom solutions for better decision-making. From Client Communications (Client Portals and Reports) and Client Management (Advisor Portals) to Digital Warehousing and Data Analytics, InvestCloud offers first-class investment platforms for successful investing that are rapid to deploy and hyper-modular. Customer segments include wealth managers, institutional investors, asset managers, family offices, asset services companies and financial platforms.

For more information, visit www.investcloud.com.

About Boston Saves

Boston Saves, the City of Boston’s Children’s Savings Account (CSA) program is designed to give families the opportunity to create a long-term savings plan for college, post-secondary education and training, for their children. The program utilizes an online platform created in partnership with InvestCloud that allows families to link any savings, checking or 529 account to a secure online platform that makes it easy to save, earn rewards, track progress and gain financial tips. Five Boston Public Schools currently participate in the pilot program for CSAs, with a universal rollout scheduled for Fall 2019.

#clientportal #advisorportal #clientcommunication #clientreporting #financialmobility #digitalplatform